7 Easy Facts About Private Wealth Management Canada Explained

7 Easy Facts About Private Wealth Management Canada Explained

Blog Article

The Buzz on Independent Financial Advisor Canada

Table of ContentsThe Best Strategy To Use For Private Wealth Management CanadaEverything about Retirement Planning CanadaThe Best Strategy To Use For Retirement Planning CanadaThe Main Principles Of Financial Advisor Victoria Bc The Best Strategy To Use For Ia Wealth ManagementIndependent Financial Advisor Canada for Dummies

“If you were to buy something, say a tv or some type of computer, might want to know the requirements of itwhat are the components and what it can do,” Purda explains. “You can think about purchasing financial advice and help in the same manner. Individuals have to know what they're purchasing.” With monetary advice, it's vital that you understand that the item is not ties, shares or any other investments.It’s things such as cost management, planning for retirement or paying down debt. And like purchasing a personal computer from a trusted organization, customers need to know these are typically getting monetary guidance from a reliable expert. One of Purda and Ashworth’s best results is approximately the fees that economic coordinators charge their clients.

This presented real no matter the cost structurehourly, payment, possessions under control or predetermined fee (within the learn, the buck property value costs was actually equivalent in each situation). “It however boils down to the worthiness idea and doubt regarding customers’ component that they don’t understand what they might be getting into exchange of these charges,” says Purda.

The Only Guide for Retirement Planning Canada

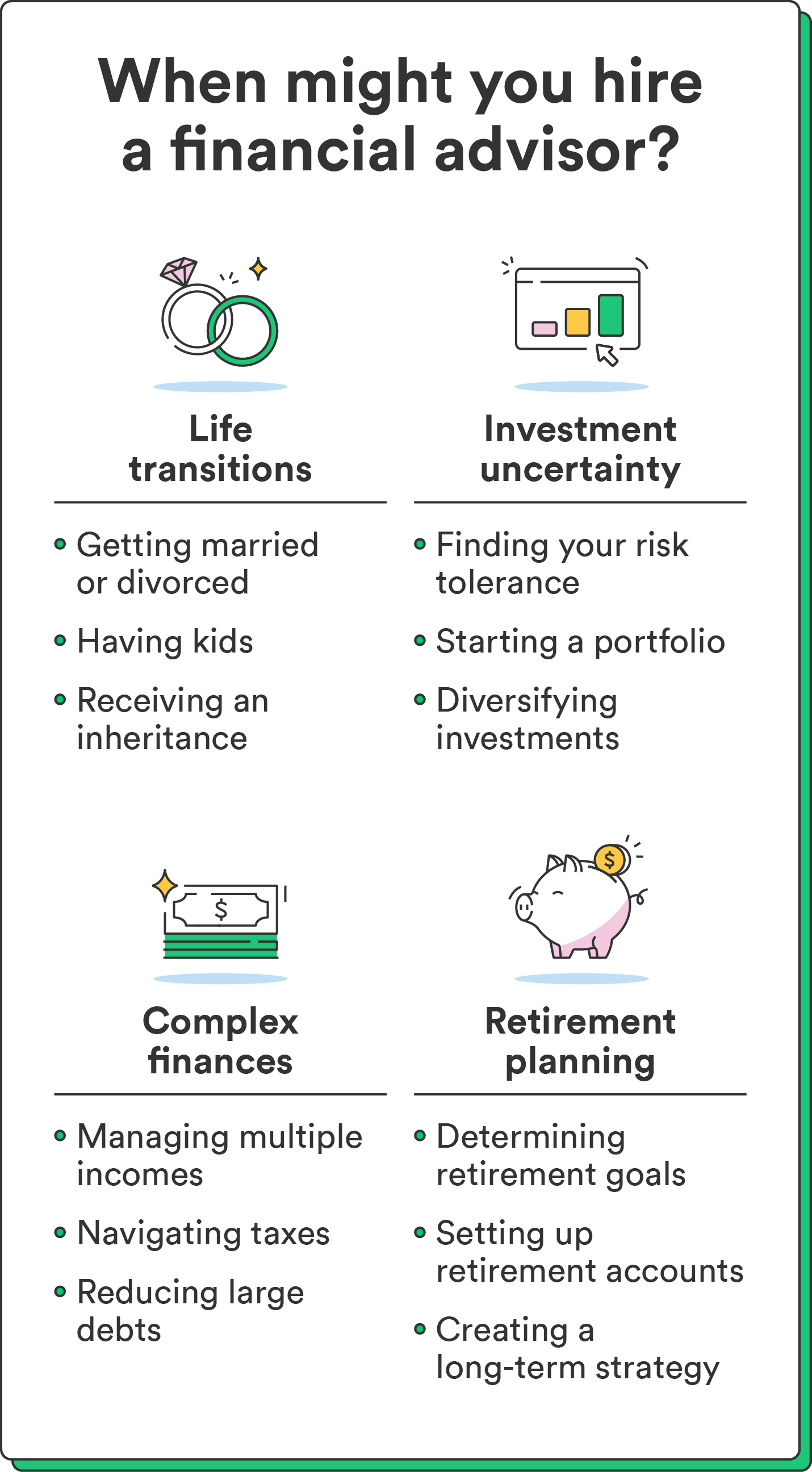

Tune in to this article once you hear the definition of financial advisor, exactly what comes to mind? Many think of a professional who are able to let them have financial information, specially when you are considering investing. That’s a fantastic place to start, however it doesn’t decorate the photo. Not really close! Economic advisors can really help people who have a bunch of different money objectives as well.

A financial advisor makes it possible to develop wide range and protect it the overall. They're able to estimate your own future financial needs and program methods to extend your own retirement cost savings. They can in addition help you on when you should begin experiencing personal protection and making use of the amount of money within pension reports to help you avoid any unpleasant penalties.

The 5-Minute Rule for Private Wealth Management Canada

They can make it easier to find out exactly what shared funds are right for you and find out here now demonstrate ideas on how to handle and also make by far the most of your own investments. They are able to in addition help you understand the threats and exactly what you’ll need to do to realize your goals. A seasoned financial investment professional will also help you stay on the roller coaster of investingeven once investments just take a dive.

Capable give you the advice you need to develop an idea so you can ensure your wishes are performed. While can’t put a price tag on reassurance that accompanies that. Per research conducted recently, the average 65-year-old few in 2022 should have around $315,000 saved to cover medical care costs in retirement.

:max_bytes(150000):strip_icc()/financial-advisor-career-information-526017_final-9c1362c7706146ada8c9173002ddee69.png)

An Unbiased View of Private Wealth Management Canada

Since we’ve reviewed what economic analysts do, let’s dig into the kinds of. Here’s a guideline: All financial coordinators are monetary experts, not all advisors are planners - https://pagespeed.web.dev/analysis/https-www-lighthousewealthvictoria-com/drv8epdit8?form_factor=mobile. A monetary coordinator focuses primarily on helping people produce intentions to achieve lasting goalsthings like beginning a college fund or keeping for a down repayment on a home

Exactly how do you understand which economic advisor suits you - https://www.4shared.com/u/kgVWRQiu/carlosprycev8x5j2.html? Check out steps you can take to be certain you are really hiring best person. What do you do once you have two poor options to choose from? Simple! Find even more possibilities. The greater number of choices you may have, the more likely you are to create a great choice

The Basic Principles Of Financial Advisor Victoria Bc

The wise, Vestor program makes it simple for you by showing you to five monetary advisors who is able to last. The good thing is actually, it is free attain associated with an advisor! And don’t forget to come calmly to the meeting prepared with a list of questions to inquire about to help you ascertain if they’re a great fit.

But tune in, even though an expert is wiser than the typical bear doesn’t let them have the authority to reveal what you should do. Sometimes, analysts are loaded with by themselves simply because they convey more degrees than a thermometer. If an advisor starts talking-down to you personally, it's time for you to demonstrate to them the entranceway.

Just remember that ,! It’s essential that you as well as your monetary advisor (whoever it eventually ends up being) take equivalent page. You desire a consultant that has a long-lasting investing strategysomeone who’ll promote you to definitely hold trading consistently whether the market is upwards or down. lighthouse wealth management. You don’t want to utilize a person that forces one to invest in something that’s also risky or you are unpleasant with

What Does Tax Planning Canada Mean?

That mix offers the diversification you'll want to effectively invest for any long haul. While you research monetary experts, you’ll most likely run into the word fiduciary duty. All this suggests is actually any specialist you employ must work in a way that benefits their particular client rather than their particular self-interest.

Report this page